If you’re new to FOREX trading, there are several steps you need to take in order to get started. These steps include selecting a forex broker, understanding charts, and margin trading. Once you’ve completed these steps, you’ll be ready to trade. CFD Forextotal is a new forex robot that uses a combination of automated trading and technical analysis to make consistent profits. It also provides traders with a number of tools and strategies that may be useful to them. This software is easy to use and may help forex traders increase profits and reduce risk.

Basics of FOREX trading

Learning the Basics of FOREX trading for beginners involves making decisions on how to execute a trade and what to do before and afterward. First, you should decide on the type of trade you’re going to make. This will affect the cost and the spread, which is the difference between the bid and ask price. You can also use a demo account to test your trading strategies.

The book also teaches you about financial risk management and explains the conventions of currency trading. Lastly, it prepares you to be a successful trader in the foreign exchange market. You will learn about the different trading styles and options that are available, and what to look for in a broker.

Choosing a forex broker

The first step to successful trading on the foreign exchange market is choosing a forex broker. Not all brokers are equal. There are many things to consider when choosing a broker, such as the fees and the registration with a regulatory body. Choosing a regulated forex broker is the best way to avoid being ripped off or scammed. Furthermore, a regulated forex broker is well-capitalized and will not go under. It is also important to look for a forex broker that makes withdrawal and deposit processes easy.

The safety of your funds should be the top priority. Choosing a broker that is regulated by a reputable financial center is a must. It will ensure that you do not lose your money due to broker scams and will help you recover your deposit in case of bankruptcy.

Using charts

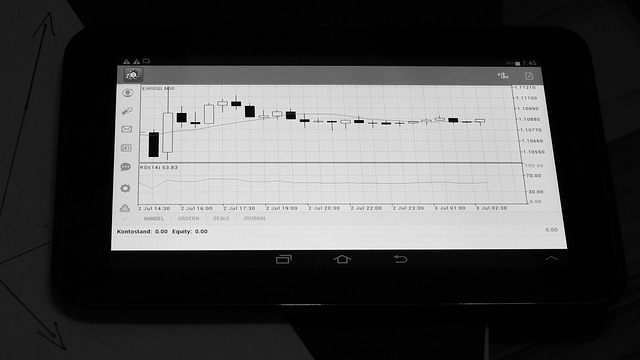

One of the most common tools for forex traders is a chart. These visual representations of data are often considered the most essential part of analyzing data. There are two types of charts, bar and line charts. While line charts do not show the opening and closing prices, they do show the high and low prices over a specified period.

Forex charts provide traders with a way to see the history of price movements and trends. By studying the price history of currency pairs, traders can determine the best time to buy and sell. They can also identify potential trading ranges.

Margin trading

Using margin trading is not recommended for beginners, because it is risky and can lead to heavy losses. New investors should use a cash account to invest their money instead. They should also learn about the market and calculate their entry points before making any trades. This way, they can avoid being unable to pay for any losses. Also, they should keep a large sum of cash on hand to cover losses. Margin trading is best for experienced investors who are sure of their price predictions.

The minimum amount of funds needed to start margin trading is $2,000. This amount is required by FINRA. However, brokerages can have their own margin requirements. You should be able to deposit a minimum of $2,000, which is equal to 100% of the price of the stock you wish to buy.