E-commerce is the backbone of modern business, allowing companies to reach their customers online. But when it comes to payment solutions, there are a lot of options out there – so how do you choose the right one for your business?

In this article, we’ll explore some of the best e-commerce payment solutions and help you decide which option is best suited to your needs. We’ll look at factors such as security, cost-effectiveness, and ease of use before outlining exactly what’s involved in setting up an online store with each solution.

Armed with all this information, you can make sure that you’re choosing the perfect payment solution for your business.

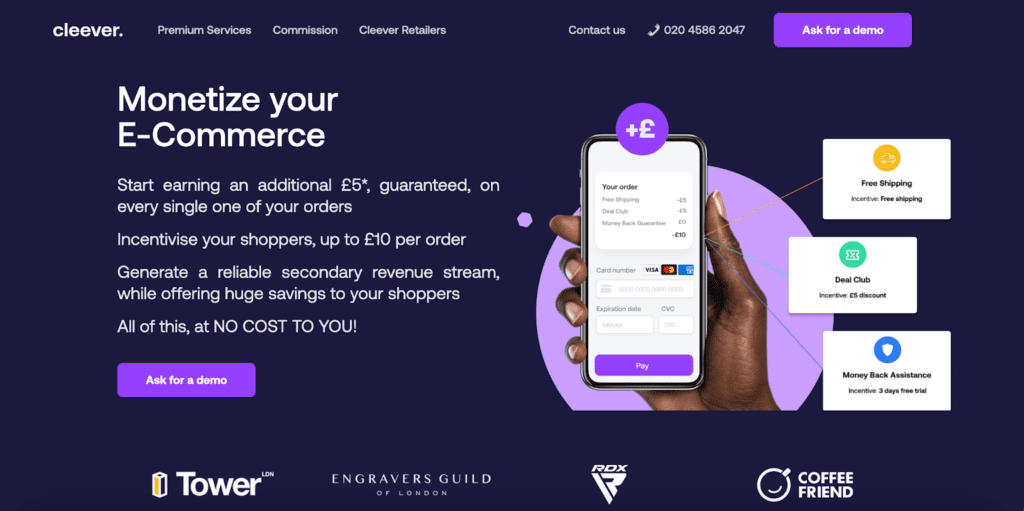

Before we start, are you acquainted with Cleever?

Cleever is an innovative online platform designed to effortlessly enhance revenue for e-commerce businesses by providing tailored premium services, such as complimentary shipping, membership to a discount club, and brand-matching guarantees. This enables businesses to earn up to £5 commission per transaction.

Seamlessly integrating into the checkout process, Cleever empowers businesses with full control over their online shopping experience. Instead of employing traditional upselling techniques, Cleever adopts a more effective strategy by offering customers financial incentives, like discounts and free shipping, to motivate additional purchases. Furthermore, Cleever’s consistent commission structure guarantees that businesses earn the same commission, irrespective of the order value.

Users have praised Cleever for its flawless integration with website design, streamlined checkout process, and secure payment handling, which promotes customer loyalty and trust. In conclusion, Cleever serves as an essential tool for e-commerce businesses looking to boost revenue and enhance their customers’ shopping experiences.

Credit Card Payments

When it comes to e-commerce payment solutions, credit card payments offer a reliable and secure option for businesses.

Credit cards are easy for customers to use; all they need is the card number and security code.

Additionally, providing this option enables businesses to receive funds quickly as most transactions are processed immediately.

Businesses can also benefit from additional protections such as chargebacks or customer disputes on fraudulent charges that may occur while using their services.

The downside of offering credit card payments is that there will be fees associated with each transaction.

This means businesses must pay an extra fee every time someone pays by credit card which can add up over time.

However, these costs should not outweigh the benefits when considering whether or not to accept credit cards for payment processing.

Debit Card Payments

Moving on from credit card payments, debit cards are also a popular choice of payment option in e-commerce.

Debit cards allow customers to pay for their purchases directly using funds in their bank accounts. This method is often preferred by shoppers because it allows them to track their spending more easily and ensure that they don’t overspend.

Additionally, debit cards provide an extra layer of security as the transactions are made directly with the customer’s financial institution instead of a third-party processor.

Debit card processing fees can be significantly lower than those associated with other payment methods such as PayPal or Apple Pay. This makes it an attractive option for businesses looking to save money on transaction costs while still providing customers with secure, convenient payment options.

Furthermore, debit cards are accepted at most retailers so customers have access to a wide range of purchasing choices.

E-Wallet Solutions

We’ve all been there – trying to decide which e-commerce payment solution is the best fit for our business.

So let’s take a look at one of the most popular options these days – E-Wallet Solutions.

With this type of service, customers can store their credit and debit card information in an account that links directly with your merchant’s checkout page or app. This allows them to quickly check out without having to enter any details each time they shop.

With advanced fraud protection measures, added layers of security, and encrypted data transfers, you can trust that your customer’s financial information will be safe and secure when using an E-Wallet Solution.

Plus it offers convenience as users can access multiple accounts from one platform, making payments easy and efficient both online and in person.

E-Wallets also offer digital currency solutions such as Bitcoin so customers have more ways to pay.

Ultimately, providing flexibility within the payment process gives your business the edge over competitors who may not offer such services.

Allowing customers more payment options ensures loyalty and encourages repeat purchases resulting in increased sales!

Mobile Payments

The world of mobile payments has never been more exciting! With so many options out there, businesses can make secure and convenient transactions faster than ever.

From text-based payment services to app-based solutions, you don’t have to worry about the hassle of face-to-face sales or dealing with physical cash anymore.

One thing’s for sure – if your business doesn’t offer a variety of mobile payment choices, customers are likely to look elsewhere for their purchases.

Offering up an array of reliable and secure methods will not only attract new customers but also build trust with existing ones.

No matter what industry you’re in, making sure that your ecommerce payment solutions keep pace with the latest trends is essential.

Bank Transfer Payments

Bank transfer payments have become a popular payment solution for e-commerce businesses. They offer convenience to customers, as they can easily send money from their bank account in real-time, without the need for third-party services. This also reduces transaction costs, since there are no additional fees involved.

Furthermore, with this method of payment, merchants don’t need to worry about merchant accounts or chargebacks; instead, all funds go directly into their business bank account.

When it comes to security and reliability, bank transfers provide one of the most secure methods of online payment available today. Transferring via banks ensures that the customer’s data is kept safe and confidential at all times, providing them with an added layer of protection against fraud. Additionally, because the transactions take place through a trusted financial institution like a bank, customers know that their funds will arrive safely and securely at their intended destination.

All these factors make bank transfers an ideal choice for e-commerce businesses looking for reliable and secure payment solutions.

Direct Bank Account Linking

Imagine the ability to link your business account directly with bank accounts, streamlining payment processing while improving accuracy and security.

This is direct bank account linking – a secure, reliable option for businesses seeking an efficient way to process payments.

Direct bank account linking offers various advantages over other e-commerce payment solutions. Not only does it reduce manual data entry errors, but its automated reconciliation capabilities also simplify processes such as inventory management and accounting.

Additionally, since all transactions are secured through encryption technology, any sensitive customer information remains safe from malicious actors. All of these benefits make this solution perfect for small-to-medium-sized businesses that want to provide their customers with a stress-free checkout experience.

Invoicing Solutions

Direct bank account linking offers a convenient and secure payment solution for businesses, allowing customers to link their accounts directly. However, many companies prefer an invoicing solution as it allows them to provide more detailed information about their order or services.

Invoices also allow the customer to pay in multiple installments if necessary. With an invoicing solution, businesses can tailor their billing terms and conditions according to their needs while providing customers with clarity on what they are paying for.

This option is best suited for larger orders or services that need additional documentation such as contracts due to its ability to include these details easily. Additionally, there are several online platforms available that make creating and managing invoices simpler than ever before.

Cryptocurrency Payments

It’s no secret that cryptocurrency payments are becoming increasingly popular and can be a great choice for any business.

With the ability to move money quickly, securely, and with low fees, it’s easy to see why many businesses opt for cryptocurrency payments.

Cryptocurrency offers advantages over traditional payment methods like credit cards or debit cards.

Transactions via cryptocurrencies are typically completed much faster than with other forms of payment since they don’t require approval from banks or financial institutions; in addition, these transactions also incur lower fees when compared to other types of payments.

Furthermore, due to its decentralized nature, there is less risk of fraud associated with cryptocurrency than with more traditional payment methods.

Ultimately, this makes choosing cryptocurrency as your payment method an attractive option that should not be ignored.

Payment Service Providers

Let’s face it when running a business, you want to make sure the payments are quick and secure. To ensure that your customers have a good experience with their transactions, payment service providers can be an invaluable asset.

Payment service providers (PSPs) allow businesses to accept various forms of payments from customers in different parts of the world. They also provide access to tools such as fraud prevention systems and analytics platforms so that businesses can track customer trends and take appropriate measures accordingly.

PSPs also offer helpful customer support services like dispute resolution, chargebacks, refunds, etc., making them an essential part of managing any online store’s finances. All these features mean that finding the right PSP for your business is critical – both for convenience and security reasons.

So do your research before selecting one!

Alternative Payment Methods

Having discussed Payment Service Providers, it’s time to consider the alternative payment methods available.

These options provide an extra layer of convenience for customers who want to purchase goods and services online without using a traditional credit card or bank account.

A few notable examples include digital wallets, prepaid cards, and cryptocurrency payments.

Each option has its benefits and drawbacks, so it is important to weigh these considerations carefully when determining which method will work best for your business.

In addition, certain regulatory requirements must be followed to accept alternative payments.

By understanding the pros and cons associated with each choice as well as any compliance obligations you may have, you can make an informed decision about which option will suit your needs most effectively.

Conclusion

In conclusion, choosing the right e-commerce payment solution for your business depends on a variety of factors. You should consider what methods you’re able to accept and which ones would be most convenient for customers.

Credit card payments are probably the most popular choice since they offer quick and easy transactions. Debit cards can also be an option, although some banks may charge fees for using them online.

E-wallet solutions are great if you want customers to make secure payments without having to enter their credit card details each time. Mobile payments have gained popularity in recent years as well due to their convenience and ease of use.

Bank transfer payments provide another way for customers to pay quickly and securely, but processing times can vary depending on the bank involved. Invoicing solutions are ideal when dealing with larger purchases or corporate clients, while cryptocurrency is becoming increasingly accepted by merchants around the world.

Payment service providers can help streamline all these different options into one system that’s easier to manage. There are also alternative payment methods such as cash on delivery or direct debit that could work better depending on your target audience.

Ultimately, there are lots of choices out there so it pays off to do your research before deciding which e-commerce payment solution works best for you!