One popular family wealth management service is Accountable Financial Services. In this post, you will learn 5 tips for choosing the best family wealth management services.

5 Tips for Choosing the Right Family Wealth Management Services

1. Do your research – Start by researching the different wealth management services that are available to you. You want to make sure that you choose a service that meets your specific needs and budget.

2. Ask questions – Make sure that you ask your family advisors about their services and how they will help to ensure your family’s financial security.

3. Talk to your family – Once you have chosen a wealth management service, discuss it with your family members. They may have questions or suggestions that you hadn’t considered.

4. Think long-term – Make sure that you are choosing a wealth management service that will help you meet your long-term financial goals. Not all services are created equal, so be sure to compare offerings carefully before making a decision.

5. Trust your instincts – If something doesn’t feel right, don’t do it! Stick with a service that feels good for you and your family members, and don’t be afraid to ask for advice if you need it.

What is Family Wealth Management?

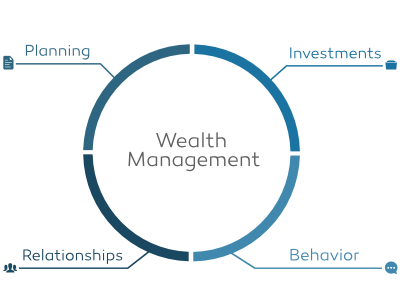

Family wealth management is a type of financial planning that helps individuals, families, and groups plan for their long-term financial security. Family wealth management services in the UK help to manage the investments and finances of a single family member. This type of financial planning can help individuals save for their future, protect their assets, and make sure their money is managed in a responsible way.

There are a number of things to consider when choosing a family wealth management firm. First, make sure the firm has experience handling your specific type of family wealth. Second, look for a firm that has a strong reputation and is licensed by the appropriate insurance companies. Third, ask questions about the firm’s fees and how they will be calculated. Fourth, review the company’s portfolio to make sure the services it offers are right for you and your family. Finally, don’t hesitate to contact the firm if you have any questions or concerns.

Purpose of Family Wealth Management Services

One of the most important factors to consider when choosing a family wealth management service is the purpose of the service. There are a variety of services available, and it’s important to find one that fits your needs and budgets.

Some services are designed to help families manage their wealth for long-term goal attainment. These services may include managing asset allocations, helping to create a plan for retirement, and developing investment strategies.

Other family wealth management services are designed to help families manage their money quickly and easily. These services may include providing access to banking and investing products, as well as assisting with budgeting and tax planning.

It’s important to choose a service that fits your needs and priorities. Once you have found a service that meets your needs, be sure to schedule a consultation so that you can get started on your journey to financial security.

Duty of Care

One of the first things to consider when choosing a family wealth management service is your duty of care. This means that the service provider must take care of your assets as if they were their own. They should have a clear plan for how they will manage and grow your money, and they should be transparent about what fees they charge.

It is also important to choose a service provider who has experience in family wealth management. They should be able to offer advice on how to protect and grow your money, as well as provide support during times of financial stress. Furthermore, a reputable family wealth management service should have a good reputation in the community. This will ensure that you can trust them with your money.

What to Consider when Choosing a Service

When choosing a family wealth management service, it is important to consider a number of factors. First and foremost, it is important to identify your goals and objectives for using the service. You also need to assess your budget and financial needs. Next, you need to decide which features are most important to you. Finally, you should look at the specific services that the service offers.

Each family wealth management service has its own strengths and weaknesses. It is important to carefully review all of the information available before making a decision. You may find that one particular service is better suited for your goals and objectives than another.

Who to Contact for Assistance

There are a number of resources available to help individuals choose the right family wealth management services. One word of caution, though: not all families who use these services are actually happy with the results.

Start by contacting your family’s financial advisor or planner. They will be able to provide you with a list of reputable firms and suggest which ones would be best for your family. If you’re not comfortable with this option, consider contacting your state insurance commissioner or financial institution. They may have information on reputable firms in your area.

Once you’ve found a suitable firm, it’s important to meet with them and understand their approach. Be sure to ask questions and gather information about their fees, services, and guarantees. It’s also important to get a sense of how often they’ll review your family’s finances and whether they have any experience working with families with complex financial challenges.

Finally, remember that no one recommendation is right for every family. Work together with your chosen provider to create a personalized plan that meets your goals and needs.

Conclusion

When it comes to family wealth management, there are a lot of options out there. It can be difficult to decide which services are right for your unique needs and goals, but with a little research, you should be able to find the perfect fit. Here are some tips for choosing the best family wealth management services:

-Do your research and look at reviews. This will help you get an idea of what kind of service is available and how satisfied customers have been.

-Consider what kind of support you need. Do you want Ongoing Financial Management (OFM)? Do you need 24/7 access? Do you want assisted transactions or guidance?

-Pay attention to fees and costs. Are there any associated fees that could impact your bottom line? How much do the services cost per month or year?

-Think about how long you plan on using the service. Do you want a short or long term commitment?